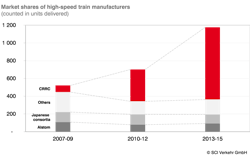

China’s Manufacturer Heavily Dominates World Market for New High-Speed Trains

More than 90% of all high-speed trains are currently being delivered by only three manufacturers. The market concentration is as high as it was at the time high-speed transportation was introduced decades ago. CRRC alone covers two thirds of all current deliveries, but most other manufacturers were not able to maintain their market share. This concentration took place in a dynamically growing market which today stands at EUR 9.9 billion. The expected decline of new high-speed train procurement's does not only result in a negative growth rate of -3.9% p.a. (CAGR) until 2020, but also leads to an increasing competitive pressure for manufacturers. In contrast, the after-sales market (EUR 6.0 billion) will grow at a dynamic +8.8% p.a. (CAGR). In its study “High-speed and Intercity Transport – Global Market Trends”, SCI Verkehr analyses global, regional, as well as country-specific developments.

The Chinese demand is responsible for the decline in the procurement of new trains. It currently generates two thirds of the overall market volume. While China will continue to expand its network, the corresponding procurement's of new trains will not remain at the current record level. Established markets in East Asia and Western Europe generate a large share of the remaining demand and will continue to invest in their fleets. Especially the markets of Japan, France, the UK, and Germany will remain globally relevant. There will be a significant shift among other markets in these two regions. For example, Switzerland, Belgium, and the Netherlands will invest heavily into large new fleets of intercity high-speed trains for up to 250 km/h. The volatility taking place even in the established markets emphasizes the dependence of the market and its manufacturing industry on single but large procurement projects.

The concentration in the manufacturing industry partly stems from the importance of the Chinese market. Established manufacturers from Western Europe and Japan had supplied trains through joint ventures since the introduction of high speed rail in China. But they were gradually replaced by CNR and CSR which merged into CRRC in 2015. Number 2 and 3 in the market are the Japanese consortia around Kawasaki as well as Hitachi, and French Alstom group, respectively. Both managed to keep their deliveries constant due to a strong home market and, in the case of Alstom, because of several export orders. But they lost market shares due to the dynamic growth of the market, dropping from around 20% each (2007-09) to around 10% each. Most other large manufacturers such as Siemens, Bombardier, CAF, Talgo, and AnsaldoBreda lost both in absolute and relative terms.

SCI Verkehr expects both further sales potential in accessible third markets as well as increasing competitive pressure. Several orders are expected from countries which currently do not possess their own manufacturing industry for high-speed rolling stock. These orders will be accessible to the whole industry, although local content will play a critical role for the awarding of the contracts. At the same time, competition will increase in these third markets. This is attributable to the established suppliers from Western Europe and Japan already being active on international markets. On the other hand, one aim of the merger of CNR and CSR is a strengthened global presence and CRRC pushes for an internationalization also in the high-speed segment due to the prospect that its domestic market declines in the future. It had already been awarded a contract in China before the government revised its decision. This makes Indonesia the destination of China’s first high-speed train export at the end of this decade.

At least the after-sales market with a current volume of around EUR 6.0 billion will grow by a dynamic 8.8% p.a. until 2020 (CAGR). This market also provides further market potential for the manufacturing industry as more and more (less experienced) operators prefer to outsource maintenance of the vehicles to manufacturers.