Good news/bad news for New York MTA: Congestion pricing moves forward, but fiscal cliff is closer too

New York Metropolitan Transportation Authority (MTA) is taking a step closer to implementing its Central Business District Tolling Program, also known as congestion pricing, but the progress comes as an updated financial plan shows the transit system is a full year closer to financial crisis than what was projected in February as it faces a deficit expected to grow to $2.5 billion in two years.

“Identifying new, dedicated revenues to fund mass transit is imperative as we seek to address our fiscal cliff,” said MTA Chair and CEO Janno Lieber. “Transit is essential to the economic future of New York as we continue to recover from the pandemic, and it should be treated as an essential service, with strategies that don’t just put the problem on the backs of our riders through painful service cuts and fare increases.”

Congestion pricing

MTA’s plan for congestion pricing, put simply, would levy a toll from vehicles that entered or stayed in New York City’s Central Business District. The net revenues would fund improvements on New York City Transit buses and trains (80 percent of funds), Metro-North Railroad (10 percent of funds) and Long Island Rail Road (10 percent of funds).

This week, MTA said the Traffic Mobility Review Board, which will recommend toll rates, credits, discounts or exemptions for the program, had been empaneled with five members. The Traffic Mobility Review Board members will include the five MTA appointees and one from New York City Mayor Eric Adams; MTA says all members have experience in public finance, transportation, mass transit or management.

Carl Weisbrod will serve as chair of the board and he will be joined by John H. Banks, president emeritus of the Real Estate Board of New York, Scott Rechler, chair of the Regional Plan Association, Elizabeth Velez, president and principal of the Velez Organization and Kathryn Wylde, president and CEO of the nonprofit Partnership for New York City.

In addition to the naming of the MTA appointees to the Traffic Mobility Review Board, the agency anticipates releasing the Environmental Assessment for the program on or around Aug. 10. Following the Environmental Assessment’s release, MTA will hold six virtual public hearings to gather feedback on the assessment throughout August.

The successful implementation of congestion pricing is expected to have a slightly positive impact on MTA’s future ridership, but it plays a significant role in the authority’s 2020-2024 Capital Program, which anticipates at least $15 billion to fund capital investments.

Preliminary 2023 budget; updated financial plan

MTA also released its preliminary 2023 budget and updated financial plan showing lower ridership recovery, higher expenses and other factors mean an anticipated fiscal cliff could arrive in 2025 - a full year sooner than expected.

Ridership on MTA’s various modes in late 2021 and early 2022 was tracking along projections from McKinsey & Company. However, the spread of the Omicron variant sent ridership down and it has recovered to approximately 61 percent of pre-pandemic levels. Continued remote working, fewer non-work trips and customer sentiment are reasons MTA says its ridership has not rebounded as expected.

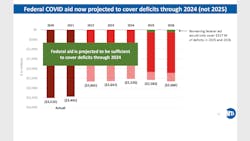

The emergency relief aid provided by the federal government should be sufficient to cover budget deficits through 2024, but it would cover approximately $327 million of deficits in 2025 and 2026. MTA says all of this leads to annual structural deficits of $2.5 billion within two years, which will rise to $2.75 billion in 2028.

"The reforecast of ridership projections has created a new higher and earlier fiscal cliff for the MTA,” said MTA Chief Financial Officer Kevin Willens. “While there is sufficient federal aid to cover structural deficits through 2024, state and city action by 2023 to create new, dedicated revenue streams to the MTA can lower the fiscal cliff to $1.6 billion and save billions in costly debt service expense.”

Willens presented a scenario to MTA’s board to offset the pending deficit by $1 billion. He says that rather than spending down the entirety of federal funds on the 2023 and 2024 deficits, those funds could be spread to decrease the medium-term cost structure and avoid costly borrowing. For this to work, Willens says new revenue sources would be required in 2023 and the MTA is engaged with stakeholders to identify new sources of funding needed to avoid large future fare increases and service reductions. In addition, MTA says it will continue to seek operating efficiencies.

The move away from borrowing is strongly supported by New York State Comptroller Thomas P. DiNapoli, who warned in September 2021 that long-term borrowing to pay for short term needs was a “dangerous practice.”

Comptroller DiNapoli noted the updated financial outlook means MTA should act “quickly and creatively to provide options to boost revenue amid service demand changes and generate cost efficiencies and saving solutions to mitigate the widening gap” between revenues and expenditures.

“The MTA has fortunately turned aside from its ill-advised plan to plug operational gaps through borrowing, which will reduce recurring debt service costs associated with the bonds. The authority also took a step forward on congestion pricing naming its traffic mobility review board, a critical step towards funding its capital plan,” said DiNapoli. “Reliable and safe mass transit is critical to revive New York City’s economy in an equitable manner. Monthly customer satisfaction surveys and recent quarterly transit summit discussions with New York City on the state of service are good steps forward, but the MTA must show how it intends to use this information to keep the public informed on how it plans to provide quality service for years to come.”

About the Author

Mischa Wanek-Libman

Group Editorial Director

Mischa Wanek-Libman is director of communications with Transdev North America. She has more than 20 years of experience working in the transportation industry covering construction projects, engineering challenges, transit and rail operations and best practices.

Wanek-Libman has held top editorial positions at freight rail and public transportation business-to-business publications including as editor-in-chief and editorial director of Mass Transit from 2018-2024. She has been recognized for editorial excellence through her individual work, as well as for collaborative content.

She is an active member of the American Public Transportation Association's Marketing and Communications Committee and served 14 years as a Board Observer on the National Railroad Construction and Maintenance Association (NRC) Board of Directors.

She is a graduate of Drake University in Des Moines, Iowa, where she earned a Bachelor of Arts degree in Journalism and Mass Communication.