The railway community’s assessment of the fragmented markets in South and Central America is mixed: Optimists call the region a “hidden champion” due to the high demand in rail transport services to fulfill the required quality of life in the cities, the growing freight volumes and many newly announced projects. Pessimists call it a “phantom market” with a high amount of announcements but very low performance. The new market study of SCI Verkehr analyses the opportunities and risks in the South and Central American railway markets.

Dominated by Brazil, this region will see very high growth rates in the urban transport segment and significant growth in the freight transport business. The current average market volume for railway technology amounts to approximately €4.6 billion. The entire market will grow at a rate of 4 percent per year. However, with a mixture of national and regional particularities, each country has its own way of development.

The market volume for railway technology products and services currently totals approximately €4.6 billion, of which €2.5 billion are for new business development and rolling stock and 2.1 billion for after sales services. Up to 2017, the overall market will continue to grow at a rate of 4 percent per year to almost €5.6 billion. The Region of South and Central America is going through a boom in urban rail construction and provides great opportunities for international companies to expand on the market, especially in rolling stock delivery or realisation of turnkey projects.

Brazil’s railway market has a dominant position in the region of South and Central America. This market has more than a 50 percent share of the entire railway technology market volume in this region, and an 85 percent share based on cargo transport performance. Naturally, all major infrastructure projects, as well as the procurement plans of rolling stock are concentrated in Brazil. The further development of other countries in Latin America is of particular interest, and is therefore one of key issues of the new market study “The railway market in South and Central America”.

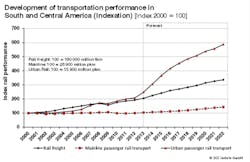

A large increase in the railway freight and urban rail passenger transport is expected due to numerous projects which are under construction or to be awarded in the nearest future. Further exploitation of the continent’s natural resources will push forward the development of freight corridors, especially connecting larger ports in the hinterland. Brazil alone wants to award 12 concessions to construct 10 000 km of new railways in 2013. In contrast, long distance transport plays only a minor role. SCI Verkehr estimates a 7 percent p.a. growth for the freight transport performance and 17 percent p.a. for the urban rail transportation performance.

Several countries in the region of South and Central America will make a major investment in railway infrastructure with financial support from abroad. However, the precarious economic situation in some of the countries and to a certain extent also their political situation may delay the implementation of the proposed projects. The following countries are likely to show a positive development in the rail sector in the medium term: Brazil, Chile, Colombia, Ecuador, Peru and Uruguay. In contrast, countries such as Bolivia, Paraguay and Venezuela are unlikely to carry out large infrastructure projects.

The study contains a number of fact sheets illustrating the development in each country of the region including major infrastructure projects and a description of future prospects. Additionally, markets for infrastructure products, system technology and rolling stock and the information about most important players on the market are presented.

The MultiClient Study “The railway market in South and Central America – Facts, Figures, Players and Trends” is available in English from SCI Verkehr.