The insurance linked securities markets were founded largely to transfer peak catastrophe risks and volatility associated with those risks. ILS products provide an alternative form of risk management protection to traditional non-proportional insurance or reinsurance. Catastrophe bonds are the most common ILS product. A catastrophe bond is a debt security designed to pay losses following a major catastrophe in the event certain negotiated conditions are satisfied as a result of the catastrophe. Since insurance securitization was pioneered in the mid-1990s, more than $49 billion of property-exposed risk has been transferred to the capital markets in the form of catastrophe bonds.

Currently, there is around $18 billion in property catastrophe bonds on risk, the highest level since the market’s inception.

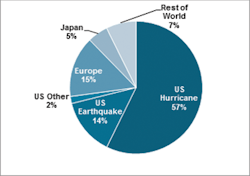

As of Oct. 31, 2013, 73 percent of all property catastrophe bonds had underlying exposures to U.S. perils, including hurricane, earthquake, severe thunderstorm, winter storm and brushfire, as measured by contribution of expected loss.

The ILS market has been focused on peak property risks, however, new structures continue to be developed and new perils securitized.

Since January 2012, an estimated $5 to 6 billion in new capital has entered the market, with around $3 billion flowing into the market during 2013. These large capital inflows have created strong demand from investors for new issuance. In 2013, sponsors began benefitting from this demand, with transactions often closing at spreads below the rates expected in the traditional (re)insurance markets. Spreads were down between 30 and 45 percent in the first half of 2013, compared to the fourth quarter of 2012. This spurred a very active period of issuance for the first half of 2013, which continued well into the third quarter. Investors kept pace with the primary activity, even during periods where many transactions were on offer simultaneously.

Motivations for Sponsoring Catastrophe Bonds

Catastrophe bonds are typically complementary purchases to a larger risk transfer program, and cedents may consider issuing for a number of reasons, including:

- The ability to secure a fixed price over a multi-year period help companies manage the volatility of pricing cycles

- Potentially lower cost of coverage

- Accessing a diverse source of capital or securing additional capacity, with traditional reinsurers comprising a relatively minor share of the ILS markets

- Fully collateralized limits mitigate a ceding company’s exposure to capital providers’ credit risk for very large industry events

- Providing enhanced structured alternatives to the standard annually-renewable per occurrence cover. Aggregate and subsequent event covers, as well as top-and-drop structures, are regularly issued into the market

- Quick payouts may be achieved by utilizing certain non-indemnity structures, such as parametric triggers

The majority of ceding companies utilizing the catastrophe bonds are primary insurance companies, which comprise more than 50 percent of the market, followed by reinsurance companies. Government-backed sponsors, such as residual markets, and corporations comprise almost 20 percent of the market today.

Structure

The ceding company will enter into an insurance agreement or counterparty contract with an offshore special purpose vehicle. The sole purpose of the vehicle is to fulfill its obligations under this contract with the ceding company. Common domiciles for special purpose vehicles include Bermuda and the Cayman Islands, where there is no taxation at the entity level.

Depending on the sponsor’s requirements, either derivative or insurance accounting treatment may be used for a catastrophe bond transaction. The governing document between the ceding company and the special purpose vehicle is a counterparty contract for a derivative, or swap, transaction, as compared to an insurance agreement for insurance accounting treatment.

A ceding company may also consider utilizing a captive. The original ceding company would cede premiums to the captive, which in turn would make the insurance premium payments to the special purpose vehicle.

Recovery Mechanics

Sponsoring companies have several structural options available for potential recovery. Over the years, significant shifts have been seen between indemnity and non-indemnity structures. The indemnity structure most closely resembles the traditional reinsurance market ultimate net loss cover and offers sponsors the ability to recover based on actual losses.

Other non-indemnity triggers have been used for a variety of reasons: quality of underlying data; commercial availability of catastrophe models or quality of the models; and, disclosure concerns.

Model acceptance and basis risk are important aspects of ILS transactions that need to be properly assessed by both sponsors and investors alike.

Indemnity and industry index are the most commonly utilized recovery mechanisms. In the last couple of years, sponsors have secured indemnity coverage with increasing success.

Non-indemnity triggers, including industry loss, modeled loss and parametric triggers, require analysis of the basis risk inherent in the structure.

The timing of insurance payments will vary depending on the recovery basis. Recoveries from indemnity transactions will be based on actual paid losses and loss reserves. The paid losses and commutation calculations for loss reserves are also verified by independent parties. This process typically takes a few years for large events. However, recoveries based on parametric or modeled loss triggers typically only require a number of months for the payment to be received.

ILS Investors

Catastrophe bonds are not registered securities with the Securities and Exchange Commission, and so may only be offered and sold to Qualified Institutional Buyers. QIB purchasers of catastrophe bonds are institutions that have met the suitability requirements of a 144A security. Under Rule 144A, an institution needs to manage at least $100 million in securities from issuers not affiliated with the institution to be considered a QIB.

There are more than 100 experienced catastrophe bond investors, of which about 50 actively participate in new transactions. Investors may be categorized according to five broad types: dedicated catastrophe funds; institutional funds that includes pensions, mutual funds, and hedge funds; and, reinsurer-sponsored funds.

The composition of the ILS market investor base has significantly changed over time. Some of this change is simple market maturation, whereby some of the early promoters and investors, such as reinsurers, provided a much needed endorsement of the market in its early days. As more investors enter the space, traditional reinsurer participation has declined. Other contributing factors include industry and economic factors, such as post-event opportunities or financial stress, as was experienced in the global financial crisis in 2008. Following a large loss event, opportunistic investors, such as hedge funds and other proprietary funds, often increase their allocation to (re)insurance as expected return levels rise with the market. Conversely, when the market opportunity softens these opportunistic investors tend to reduce their allocations or exit entirely.

Utilization of Catastrophe Bonds for the Rail Industry

In 2013, First Mutual Transportation Assurance Company, which is a subsidiary of the Metropolitan Transportation Authority, secured $200 million in coverage for three years from storm surge caused by named storms impacting the New York area. The recovery mechanism utilizes a parametric structure based on water height levels at various measuring gauges.

Outlook

Despite compression in ILS spreads, we continue to see new capital flowing into the market on a direct and indirect basis. These investors are long term in nature and may stay invested even if interest rates improve in traditional investments. Spread levels achieved in the first half of 2013 are expected to continue for the remainder of the year and into 2014. The willingness of ILS investors to broaden the risks available for securitization has already brought new interest from sponsors in ILS market initiatives. The market may continue to broaden the scope of coverage beyond vanilla natural catastrophe risks and find innovative ways to utilize the fresh new capital sources.

Repeat and, increasingly, new sponsors are accessing the ILS market to leverage the favorable market conditions. Issuance momentum will be strong through the rest of 2013 and into 2014. Conditions remain positive for the catastrophe bond market, with 2013 issuance on track to reach $7 billion in total.

Erin Lakshmanan is a director at Aon Benfield Securities, Aon Benfield’s reinsurance investment banking team, and is responsible for providing insurance-linked securities solutions to clients. She specializes in the structuring of catastrophe bond transactions. After she joined Aon Re Australia in 2005, Erin spent two years working in both the catastrophe and actuarial analytics teams. Following this, she spent one year working as a reinsurance treaty broker before relocating to Chicago to join the investment banking team. Since joining Aon Benfield Securities in 2008, Erin has been in involved in structuring more than 40 catastrophe bonds. With a background in actuarial studies, she also holds a Bachelor of Engineering (Civil) degree from the University of Sydney. Paul Schultz is Chief Executive Officer of Aon Benfield Securities, the investment banking division of Aon Benfield. Paul joined Aon in October 2000 after spending 15 years in the commercial and investment banking industry. Prior to joining Aon, he was the head of Chase Securities' Midwest-based Insurance Investment Banking Group, advising clients on mergers and acquisitions, leveraged finance, structured products, and debt issuance. Paul also serves as Treasurer of Northwestern University's Public Issues Committee.